Marine Finance

If you're thinking about purchasing a Honda, Suzuki or Tohatsu outboard motor or a Honwave or Highfield Rib, you may be wondering how you're going to pay for it. One option that's worth considering is marine finance, which can help you spread the cost of your purchase over a period of time. In this blog post, we'll explore some of the advantages of using marine finance to buy your next outboard or small boat.

Flexible payment options

One of the biggest advantages of using marine finance is that it gives you flexible payment options. Rather than having to pay the full amount upfront, you can spread the cost of your purchase over a period of time. This can be particularly helpful if you don't have the funds available to pay for the full amount upfront, or if you'd prefer to keep your savings in the bank.

Interest-free financing

Another advantage of marine finance is that many financing options offer interest-free financing for a period of time. This means that you can pay off the balance of your purchase without having to worry about paying additional interest charges. This can be a great option if you're looking to pay off your purchase relatively quickly.

Affordable monthly payments

Marine finance can also offer affordable monthly payments, which can help you fit your purchase into your budget. For example, outboards can start from as little as £15 per month interest-free. By paying a small amount each month, you can enjoy the benefits of owning a new outboard without having to pay the full amount upfront.

Protects your savings

Using marine finance to purchase an outboard or small boat can also help protect your savings. Rather than having to deplete your savings to pay for your purchase, you can use financing to spread the cost over a period of time. This can be especially helpful if unexpected expenses come up down the road.

Access to a wider range of products

Finally, marine finance can also give you access to a wider range of products. Rather than having to limit yourself to the products that you can afford to pay for upfront, you can use financing to expand your options. This can be helpful if you're looking for a specific type of outboard or small boat that might be outside your budget if you had to pay for it all at once.

Marine finance can be a smart way to purchase your next outboard or small boat. By offering flexible payment options, interest-free financing, affordable monthly payments, and protection for your savings, marine finance can make it easier for you to own the boat or outboard motor of your dreams. If you're interested in exploring marine finance options, it's important to carefully review the terms and conditions and ensure that you fully understand the costs and fees involved.

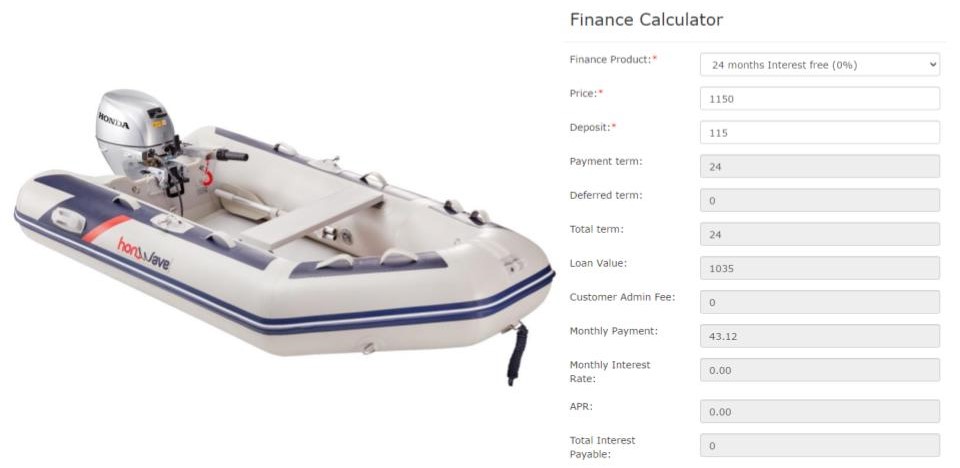

Using the link below, you will find a Finance calculator offering some competitive finance options provided by our Retail finance provider, Omni Capital. SAL Marine is authorised and regulated by the Financial conducted authority. Finance is offered subject to status. Terms and conditions apply. You must be a UK resident and over the age of 18 to apply. Finance Calculator

to save as many parts lists for boats and engines as you want. It makes reordering and costing up jobs, quick and easy!

to save as many parts lists for boats and engines as you want. It makes reordering and costing up jobs, quick and easy!